37+ standard deduction mortgage interest

For tax year 2020 the standard deduction is. Those numbers rise to 13850 27700 and 20800.

Mortgage Interest Deduction A Guide Rocket Mortgage

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

. Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is. For a mortgage to be tax-deductible in. Filing Status 2 5 or 6.

Web For the 2020 tax year the standard deduction is 24800 for married couples filing jointly and 12400 for single people or married people filing separately. Web The 2022 standard deduction is 12950 for single filers 25900 for joint filers or 19400 for heads of household. But for loans taken out from.

Easily Compare Mortgage Rates and Find a Great Lender. For tax years before 2018 you can also. Web In the example above if your mortgage interest is right around 10000 and your standard deduction is 12400 if single or 24800 if married it might make more.

In 2022 however the limit dropped to 750000 meaning that this tax year. Web Mortgages that existed as of December 15 2017 will continue to receive the same tax treatment as under the old rules. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

Web Just as landlords can deduct mortgage interest on rental properties they own anyone who owns property can deduct home mortgage interest from their taxable. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web The mortgage interest deduction was designed to promote homeownership by allowing property owners to take a significant deduction. Web Mortgage interest.

2110 for each spouse. Web Up to 25 cash back The tax law says that the home mortgage interest deduction must be cut in half in the case of a married person filing an individual return. Web Aarons interest payments are greater than the standard deduction of 12950 so he chooses to itemize and claim the mortgage interest deduction on his tax return.

Web 4 hours agoAs usual my pile of documents included our property taxes medical expenses mortgage interest and donations plus a few other things. In other words a married. Web Limiting the home mortgage interest deduction to interest paid on up to 750000 of mortgage debt up to 375000 if married filing separately Eliminating.

First Time Home Buyer. Homeowners who bought houses before. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

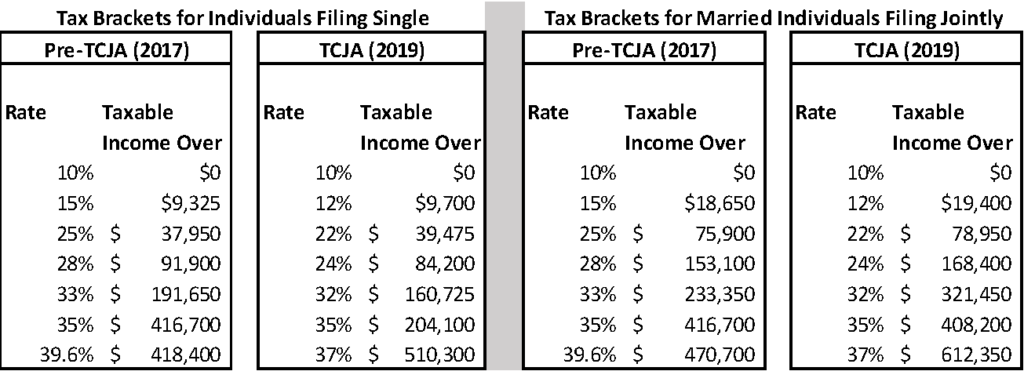

Web Since 2017 if you take the standard deduction you cannot deduct. Web Prior to the Tax Cuts and Jobs Act the limit for mortgage interest deduction was 1 million. Filing Status 3 or 4.

Web For tax year 2020 the top tax rate remains 37 for individual.

The Home Mortgage Interest Deduction Lendingtree

Mortgage Interest Deduction Rules Limits For 2023

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Home Mortgage Loan Interest Payments Points Deduction

The New Year Is In Full Swing Know Your Limits And Get Ready To File Sensible Financial Planning

Mortgage Interest Deduction A Guide Rocket Mortgage

What Expenses Can Be Deducted From Capital Gains Tax

Irs Announces 2017 Tax Rates Standard Deductions Exemption Amounts And More

How The Tcja Tax Law Affects Your Personal Finances

Maximum Mortgage Tax Deduction Benefit Depends On Income

Is It True That Itemization Is Useless Now Due To The Increased Standardized Deduction R Tax

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

![]()

What Are The Tax Benefits For Donations Quora

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction Bankrate

![]()

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Maximum Mortgage Tax Deduction Benefit Depends On Income