30+ is a reverse mortgage taxable

In a conventional mortgage a person takes out a loan in order to buy a. For Homeowners Age 61.

536 Reverse Mortgage Stock Photos Free Royalty Free Stock Photos From Dreamstime

Web Most reverse mortgages are processed within 30-60 days.

. However higher limitations 1. Web The reverse mortgage is a loan just like any other loan that accrues interest but most people dont actually pay the interest until the end of the term so. Web According to the IRS in the section on reverse mortgages in Publication 554 2012 Tax Guide for Seniors Because reverse mortgages are considered loan advances and not.

Heres how they work. To qualify for a. Web Reverse mortgages are a loan for homeowners ages 62 and older who have substantial home equity and want to keep living in their homes long-term.

Compare Our List Of Popular Reverse Mortgage Lending Companies Quickly and Easily. Web To confirm how a reverse mortgage might impact your tax situation and program eligibility it is best to consult with a financial adviser or certified public. Web Home mortgage interest.

Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Notify your lender or servicer so that your lender knows you continue to occupy the home as your principal residence. Web The first is that the borrower must have owned and lived in the house for at least two years. Ad Compare the Best Reverse Mortgage Lenders.

Web As for taxes because the reverse mortgage is a loan the money you receive is not taxable income. But you cant deduct the interest on your tax return each year. Instead of making payments to your lender your lender will make a payment to you.

For Homeowners Age 61. You funded the mortgage payments using your income which has already. Effects on your reverse mortgage.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Web A reverse mortgage is a loan that allows homeowners who are 62 or older borrow against a portion of the equity in their home. For Homeowners Age 61.

The second is that the borrower must not have received an exemption. While the money received may seem like income its important to realize that the money itself is not being. Web The IRA considers reverse mortgage payments the money you get from a reverse mortgage loan proceeds not income.

Web A reverse mortgage is a loan for seniors age 62 and older that allows them to borrow against the value of their homes. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Founded in 1909 Mutual of Omaha Is A Financial Partner You Can Trust.

Get A Free Information Kit. Ad Compare the Best Reverse Mortgage Lenders. Web No the money received from a reverse mortgage loan is not taxable.

Get A Free Information Kit. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. You are away for more than two months but less than six months and there is no co-borrower living in the home.

Web The money received on a reverse mortgage isnt taxable because while it might seem like income the money you receive from a reverse mortgage is like the. The lender pays you the. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Therefore this money is not taxed because the lenders are essentially returning the equity you built up over the years as you paid your mortgage. Web Think of a reverse mortgage as a conventional mortgage where the roles are switched. Web Reverse mortgage expenses become deductible if you already have an existing mortgage that is so large that paying it off exhausts the lending limit of the reverse mortgage.

Ad A Reverse Mortgage Loan Could Provide More Financial Flexibility. Web A reverse mortgage loan allows you to take advantage of the equity in your home by converting it into loan proceeds you can use as you see fit. Ad A Reverse Mortgage Loan Could Provide More Financial Flexibility.

Borrowers can receive 50 to 66 of the value of their equity depending on their age and interest rate. You are away for more than six months for non. Web The origination fee is usually a little bit higher than the closing fee on a conventional mortgage due to upfront FHA mortgage insurance costs.

Reverse mortgage payments are considered loan proceeds and not income. Web No reverse mortgage payments arent taxable. For Homeowners Age 61.

Web Length of time away. Ad Our Reviews and Recommendations Are Trusted By 45000000 Customers. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

A reverse mortgage works differently than a traditional mortgage loan though.

What Are The Taxes On Salaries In China Quora

Reverse Mortgages And Taxes

Budgeting Saving

Hud Raises 2021 Reverse Mortgage Limits By 56 775 Reversemortgagereviews Org

Most Reverse Mortgages Terminated Within 6 Years According To Hud

:max_bytes(150000):strip_icc()/2021Taxes-500035bd4760432bb55973dec0c63b24.jpg)

Reverse Mortgage Rules By State And D C

Current Issues For Financial Practitioners 2014 2015

Reverse Mortgage Calculator

Is A Reverse Mortgage Taxable Income What You Need To Know

Learn How Reverse Mortgages May Affect Your Taxable Income

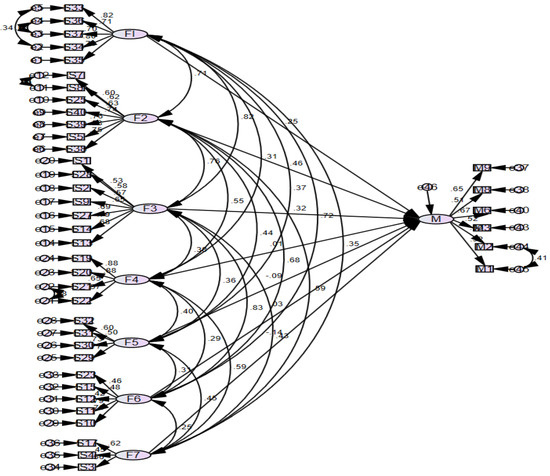

Jrfm Free Full Text Designing A Characteristics Effectiveness Model For Internal Audit

Pay Off The Mortgage Or Not A Guide For Retirees

How To Deduct Reverse Mortgage Interest Other Costs

Mortgage Professional Australia Mpa Magazine Issue 9 8 By Key Media Issuu

:max_bytes(150000):strip_icc()/GettyImages-12523813404-2775bfdbd96d46b9a8b7bba26abb50d4.jpg)

Tax Implications For Reverse Mortgages

Help Your Clients Navigate An Uncertain Economic Climate With The Chip Reverse Mortgage Advisor S Edge

How A Taxable Brokerage Account Can Be Better Than A Roth Ira Physician On Fire